does wyoming charge sales tax

The state sales tax rate in Wyoming is 4. Wyoming is a destination-based state which means that the rate you will charge your customers is determined by where they actually take possession of the product or where they receive the service.

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube

Have a question or comment.

. No counties currently hit this maximum threshold however and in most of the state the effective sales tax rate is 5 or 6. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. How To File And Pay Sales Tax In Wyoming Taxvalet Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Sales taxes in Wyoming are calculated at checkout on the APMEX website based on 1 the taxability of products sold by APMEX in Wyoming set forth above and 2 the specific tax rates established by the taxing jurisdiction of the delivery address in Wyoming. No you do not pay sales tax on labor.

For anything but a sole proprietorship you will most assuredly need one. Sales Tax On Grocery Items Taxjar. If you do not file your sales tax return within 30 days of the due date of your return you will also be charge an additional 2500.

There are additional levels of sales tax at local jurisdictions too. The use tax is the same as the. Wyoming is the cheapest state to buy a beer in the state excise tax on beer is only 002 per gallon.

You must collect sales tax at the tax rate where the item is being delivered. The wholesaler shall be entitled to retain four percent 4 of any tax collected under WS. The state-wide sales tax in Wyoming is 4.

You have to pay for these items in grocery food. This is not enough yet. In Wyoming when a tool is lost down a hole or damaged beyond repair during the pre-production casing phase of an oil or gas well the charge for the tool will not be subject to sales tax.

Although Wyoming charges 4 of sales tax a few items are exempt from the sales tax in Wyoming. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. Wyoming has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state. Sales Tax By State.

Groceries and prescription drugs are exempt from the Wyoming sales tax Counties and cities can charge an additional local sales tax of up to 2 for a. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Because that particular online store does not have an actual physical presence within your state it does not need to charge.

But the measure wasnt created. The maximum local tax rate allowed by Wyoming law is 2. Nor does the state charge a tax for transferring property to new ownership.

Many states that have a sales taxes exempt food for example but some keep food as a. 31 rows Wyoming WY Sales Tax Rates by City The state sales tax rate in. Do I need a Federal Tax ID Number or EIN to register for a Wyoming sales tax permit.

Does wyoming charge sales tax Sunday March 6 2022 Edit. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1472 for a total of 5472 when combined with the state sales tax. Groceries and prescription drugs are exempt from the Wyoming sales tax. Does wyoming charge sales tax Saturday June 11 2022 Edit.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. According to House Bill 169 raising the state sales and use tax rate from 4 to 5 could generate between 138 and 142 million for the state annually and approximately 63 million for localities. With lump-sum contracts all materials supplies labor and other charges are added together to create one price.

The state sales tax rate in Wyoming is 4. Machinery raw materials utilities fuel medical goods services newspapers general maintenance contracts custom software and lastly general trade links. If I buy cigars from a company in Colorado who is not a wholesaler in Wyoming as a Wyoming vendor am I responsible for the 20 excise tax.

Wyoming charges 60 to register a new business sales tax permit but nothing to renew an existing one. An example of taxed services would be one which sells repairs alters or improves tangible physical property. See the publications section for more information.

In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and plate fees. The current state sales tax rate in Wyoming WY is 4. State wide sales tax is 4.

You can lookup Wyoming city and county sales tax rates here. The total tax rate might be as high as 6 depending on local governments. Sales tax exemptions apply to prescription medications and groceries.

Is there sales tax on RV in Montana. This page discusses various sales tax exemptions in Wyoming. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

So if you live in Wyoming collecting sales tax is not very easy. As a business owner selling taxable goods or services you act as an agent of the state of Wyoming by collecting tax from purchasers. This is the same whether you live in Wyoming or not.

APMEX began collecting sales taxes in Wyoming in February 2019. It is also the same if you will use Amazon FBA there. Wyoming is a destination-based sales tax state.

Charge the tax rate of the buyers address as thats the destination of your product or service.

Sales Taxes In The United States Wikiwand

.png)

States Sales Taxes On Software Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

How To File And Pay Sales Tax In Wyoming Taxvalet

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

States Without Sales Tax Article

Wyoming Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

How To File And Pay Sales Tax In Wyoming Taxvalet

Ranking State And Local Sales Taxes Tax Foundation

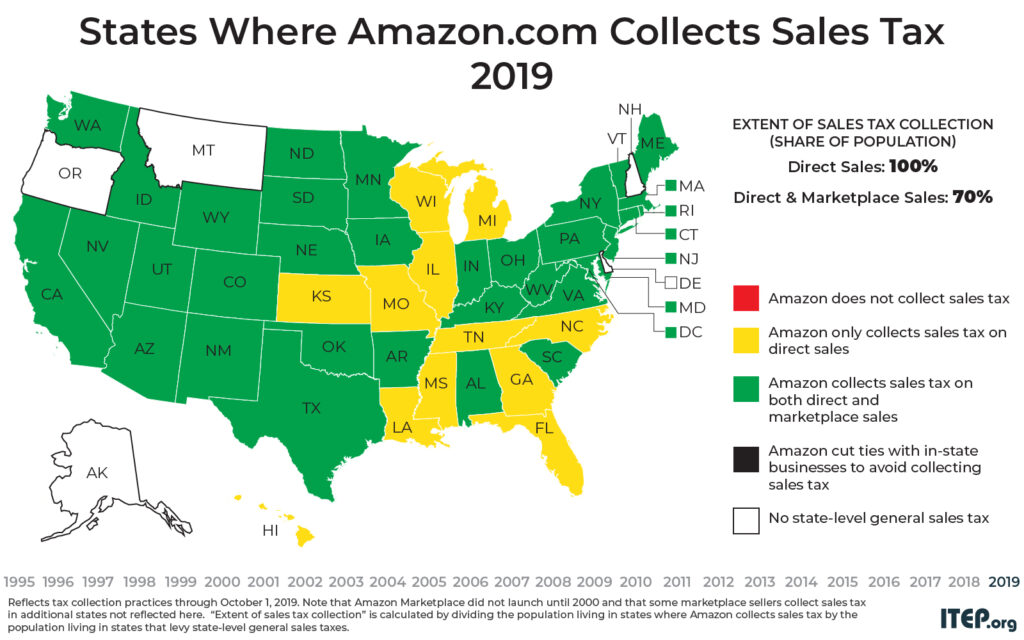

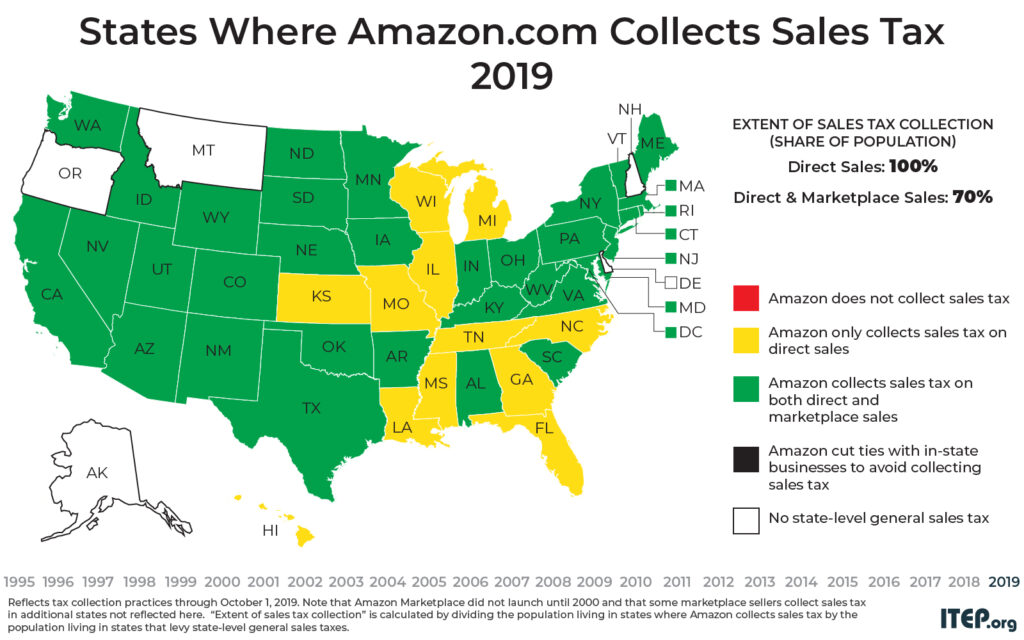

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

States With Highest And Lowest Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Updated State And Local Option Sales Tax Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)